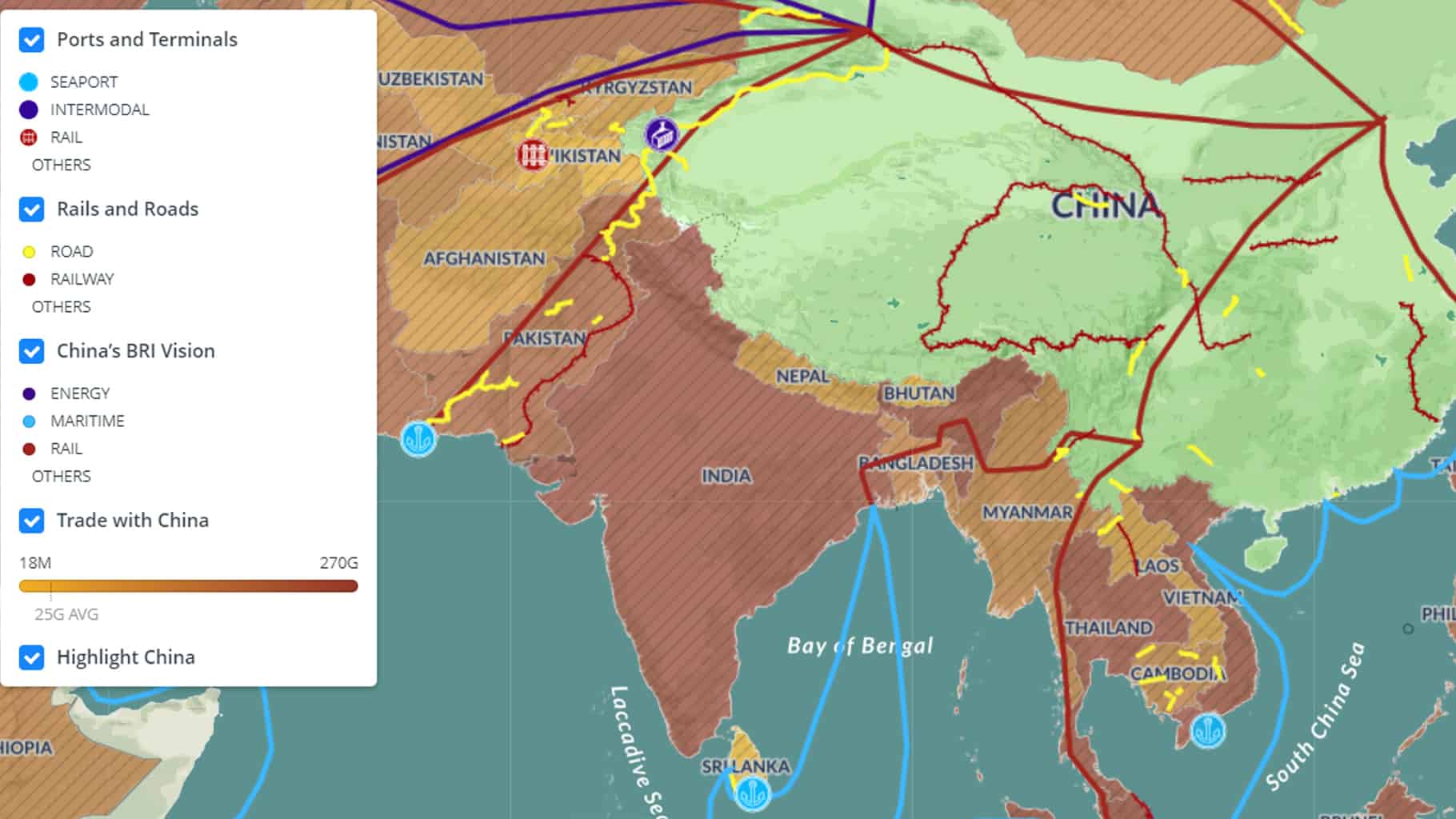

As FreightWaves has been reporting, China has continued its slow incursion into foreign markets through logistics infrastructure. The Chinese have financed and produced upgrades of railways, highways, ports and pipelines all over the world as part of an international project that has already cost more than the Marshall Plan to rebuild Europe.

China’s Belt and Road Initiative is comprised of an Overland Silk Road and a Maritime Silk Road, which would terminate in several places throughout Southeast Asia and Europe. China touts the Belt and Road Initiative as a way to enhance and celebrate economic and cultural ties with the rest of the world. But a steadily increasing surge of critics views it as a thinly veiled attempt to exert military power and political clout.

Some Asian countries that once participated in the plan are now balking. Their leaders realize the potential of China’s sway in their region and some are not pleased with the outcomes. Instead of embracing Chinese investment they have been cancelling or downsizing projects and even expressing outright opposition to the whole enterprise.

For the most part, however, Europe has not expressed opposition to the idea. This is especially true of countries on the geopolitical-economic fringe that lag the powerhouses of western Europe. For instance, given the last decade of economic hardship, Greece’s leaders have been receptive to the idea of a Silk Road passing through the country’s borders. They see a potential generator of economic activity.

COSCO, China’s state-owned shipping company (and the world’s fourth-largest shipping company), has completed a 600 million euro deal to purchase the Port of Piraeus, Greece’s largest port.

Despite outcries of exploitative operational practices by the locals around Piraeus, Greek Prime Minister Kyriakos Mitsotakis and China’s President Xi Jinping have shaken hands to move forward on further projects in the futures. COSCO has owned a majority stake in the port since 2009. Under the ownership, management and expansion of the Chinese, the port is now the second largest in the Mediterranean.

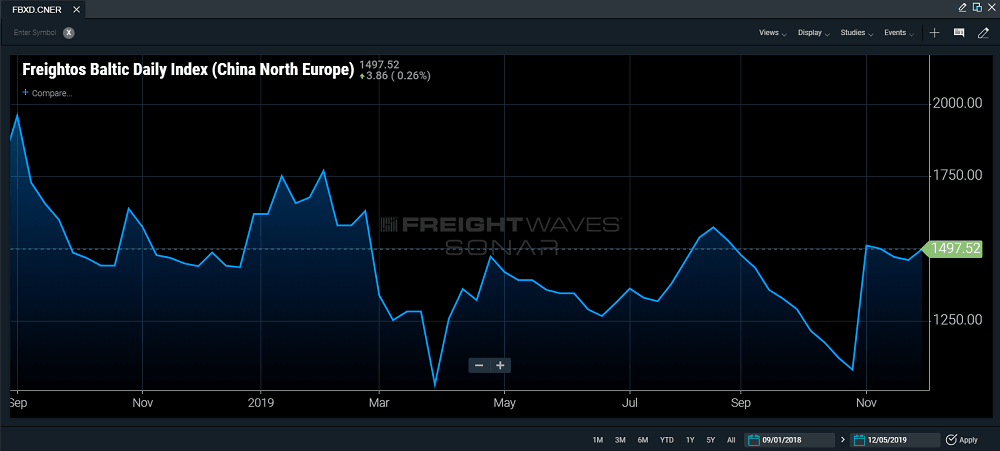

Politically there has been a lack of consistency in the way the European Union regards China. While some countries have criticized China’s humanitarian offenses, others have remained silent. Europe has long been caught in the crossfire of the U.S.-China disagreement. European leaders have insisted they can continue to uphold their connection with the U.S. while benefiting from economic ties to China. Economic activity between Europe and China often surpasses a billion euros each day.

Within the past decade, Chinese companies have bought into more than a dozen ports around Europe, most recently in Spain, Belgium and Greece. These ports account for around 10% of Europe’s maritime shipping capacity. China is Europe’s largest importer and Europe’s second-largest export market.

But on top of trade is the potential for military interaction. Europe’s leaders insist that they will not tolerate Chinese military involvement in its ports as happened in Djibouti, Sri Lanka and Pakistan, where Chinese naval deployments are currently docked. But in 2015 a small Chinese fleet consisting of a destroyer, frigate and supply ship paid the Greek port of Piraeus a friendly visit.

There are concerns that these Chinese inroads to Europe will weaken global opposition to the way China is poised to reshape global norms about privacy, internet freedom and government. But China remains adamant that its inroads into Europe, and the greater Belt Initiative, are all about global connectivity.