Much like the road freight industry in the U.S., its European counterpart suffers from similar issues with fragmentation and low visibility into logistics operations, brought about by the lack of digitalization across large swathes of the market.

Through its customs regulations, the European Union has done away with the need for border customs by enabling uniform regulations across its member nations, there are a significant number of languages and work cultures that European supply chains need to contend with, putting a strain on movement in an industry that runs heavily on interpersonal relationships between stakeholders.

InstaFreight, a Berlin-based digital freight forwarding company, is ushering in greater efficiency within the European logistics ecosystem by connecting shippers and carriers on a digital platform. The company acts as an actual freight forwarder by finding the right carrier without multiple subcontracting.

“We are not a freight exchange platform but rather the contractual party, much like a classical forwarding company. What we do differently is that we use our technical and digital expertise to improve everything related to freight transport,” said Philipp Ortwein, Co-Founder and Managing Director of InstaFreight.

InstaFreight aggregates over 10,000 carriers on its platform, making it easy for shippers to stick to InstaFreight for their capacity needs – however large they may be. “The first thing we did was to consolidate supply and demand, and then proceeded to make sure everything is digitalized for the shipper,” said Ortwein. “For instance, our pricing algorithm lets shippers get their price quotes digitally within seconds. We have a detailed understanding of which carrier drives on which lanes and of the equipment they have available. This enables us to quickly find the suitable carrier.”

The pricing algorithm constantly learns from data points and helps the company recover smarter while guaranteeing fair prices based on daily conditions. Once the quote is accepted, InstaFreight’s carrier matching tool suggest carriers based on their experience in the lane and the availability of suitable equipment from which a suitable carrier is selected.

InstaFreight also provides shippers with a track-and-trace solution, allowing them to locate their freight in real-time as it moves to its destination. The startup has also built a control tower solution that is accessible by shippers who move high freight volumes. This solution helps shippers coordinate several transports on an all-in-one interface, eliminating the need for them to call up individual dispatchers to know their freight whereabouts. Shippers can not only use this and other functions via the web-based interface but also via an API.

“We have several data sources to get the track-and-trace information. The primary one though is the on-board telematics system,” said Ortwein. “We use the location-based data off the GPS on the truck to calculate the estimated time of arrival and inform shippers proactively.”

Other sources for track-and-trace are data gleaned from InstaFreight’s application and through personal communication with the registered dispatchers.

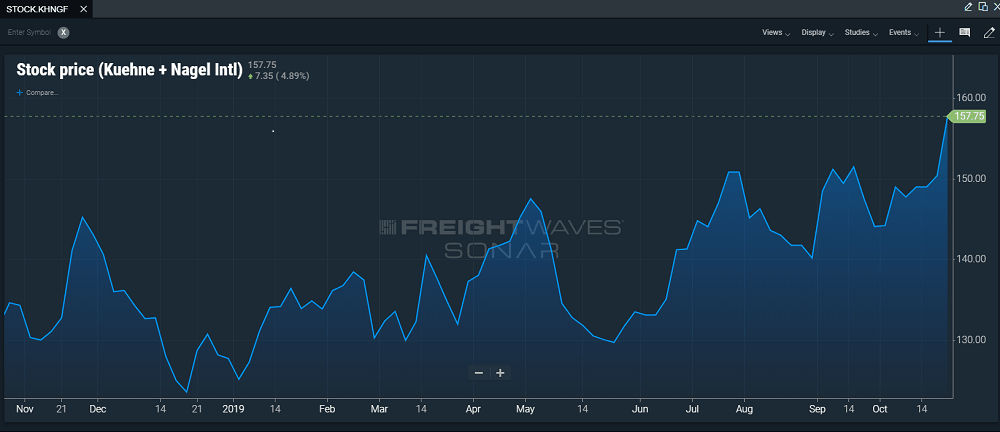

InstaFreight considers traditional freight forwarders such as DHL, Kuehne & Nagel and DB Schenker to be their competitors in the market, but does better through the digitalization layer it offers to its customers. The company currently has over 2,000 active customers on its platform, with them citing access to new capacity, end-to-end transparency and hassle-free transport handling to be the primary reasons for using InstaFreight.