In a rare bit of good news for container shipping, Maersk said full-year operating earnings will come in better than originally forecast.

The world’s largest ocean carrier on Monday said earnings before interest, taxes, depreciation and amortization (EBITDA) for 2019 will be between $5.4 billion and $5.8 billion, compared with an earlier forecast of $5 billion.

The Copenhagen-based company increased its forecast thanks to better-than-expected performance in its ocean freight segment. Despite lower freight rates and slower global demand growth, ocean freight’s results were “driven by strong reliability and capacity management combined with lower fuel prices.” Maersk also said it saw improved margins in the terminal and towage business.

Maersk said third-quarter revenue came in at $10.05 billion, down slightly from a year earlier but up 4% sequentially.

EBITDA for the third quarter was $1.656 billion, up 22% sequentially and 45% from a year earlier.

Revenue for the first nine months of 2019 is coming in at $29.22 billion, up 1.3% from a year earlier with EBITDA of $4.25 billion, up 57% from a year earlier.

The third quarter of 2019 saw some of the best months for container shipping in terms of volumes thanks to front-loading ahead of the imposition of U.S. tariffs on Chinese goods. July and August import volumes of 1.96 million and 1.97 million twenty-foot equivalent units (TEUs), respectively, were the best months for North America this year, according to the National Retail Federation. It expects September volumes of 1.9 million TEUs, the third highest in 2019.

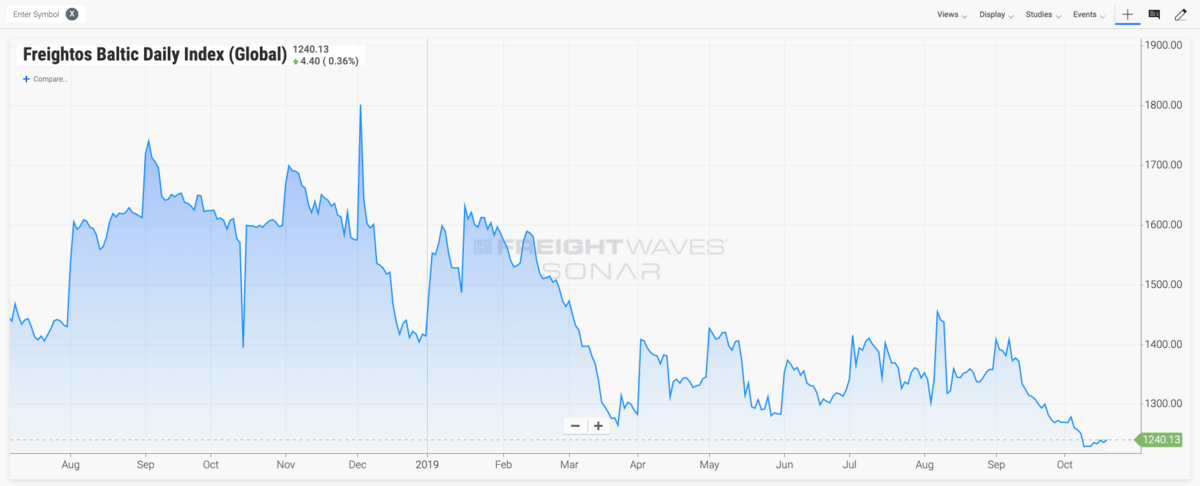

But spot shipping remains stuck at multi-year lows due to overcapacity on major trade lanes and the slowdown in U.S.-China trade volumes. The Freightos Baltic Daily Index sits at a 15-month low of $1,240 per forty-foot equivalent unit. (SONAR: FBXD.GLBL)