The full might of the DSV Panalpina (CPH: DSV) transport and logistics behemoth was unveiled earlier today when the Denmark-headquartered company reported its first quarterly results since DSV completed the $5 billion purchase of Panalpina in August.

Group revenue rose 21.2% to DKK24,521 million ($2.548 billion; 1DKK = $0.10) in the third quarter ended 30 September. Earnings before interest and taxes (EBIT) of DKK1,682 million represented a gain of 11.6%, while operating margin fell from 7.4% in the third quarter of 2018 to 6.9% in the third quarter of 2019.

“The closing of the Panalpina transaction on 19 August was the all-important event in the third quarter,” said Jens Bjørn Andersen, Group CEO. “We have had a good start to the integration and the first operational integrations have already started. Meanwhile, we are pleased to report strong results for the third quarter, despite challenging market conditions, especially in the air freight market.”

Given that around 90% of Panalpina’s revenue was generated from its air and ocean forwarding activities, the most striking third quarter year-on-year changes were evident in the integrated company’s DSV Air & Sea unit.

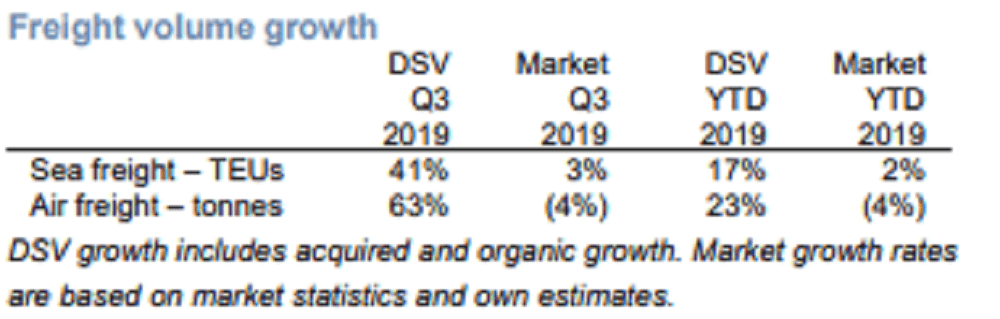

This saw ocean freight volumes measured in twenty-foot equivalent units (TEUs) rise 41% in the third quarter compared to a year earlier. Excluding Panalpina volumes, growth of 7% was reported.

The picture for air freight was even more stark. Volumes rose 63% year-on-year in the the third quarter of 2019 despite negative organic growth of 6%.

On an annual basis, DSV Panalpina now expects to handle around 3 million TEU and 1.5 million tons of air freight, making it one of the world’s top five freight forwarders with a presence in around 90 countries and a total of 61,799 employees, up from 48,182 employees at the end of the third quarter of 2018.

However, Panalpina’s troubled state before its purchase was evident in the third quarter financials, with the large volume gains failing to translate into profits.

DSV Air & Sea reported EBIT of DKK3,311 million for the first nine months of 2019, up from DKK2,796 million, yet Panalpina contributed just DKK39 million.

Jens H. Lund, chief financial officer, told FreightWaves by telephone this morning that turning Panalpina’s volumes into profits was a priority. “We have much higher productivity than Panalpina has,” he said. “We are historically more efficient and that is where the synergies are going to come from.”

Lund added, “We have to make sure we produce Panalpina volumes in the same way we have done with DSV volumes historically. If we manage to do that, we’re going to increase the earnings on the Panalpina volume and that’s going to pay for the transaction and hopefully give a return to our shareholders.”

DSV’s track record of successfully integrating major acquisitions is a good one. It has acquired DFDS Dan Transport Group, Frans Maas, ABX and UTi Worldwide since 2000. Generating cost synergies after making major acquisitions has proven fruitful in the past and will pay a key role in paying the Panalpina tab.

The company announced today (1 November) that it now expects to achieve annual cost synergies of around DKK2,300 million when Panalpina is fully integrated, up from its previous forecast of DKK2,200 million.

Around 5% of the cost synergies are expected to impact the firm’s income statement in 2019, around 60% in 2020 and the remaining 35% in 2021.

“Total transaction and integration costs are expected in the level of DKK 2,300 million,” reported the company. “These costs will be charged to the income statement under Special Items. We expect that approximately 30% of the transaction and integration costs will materialize in 2019, 55% in 2020 and 15% in 2021.”

Some of the savings will come from corporate functions as the company relocates the former Panalpina headquarters in Basel, Switzerland, to its headquarters in Denmark, a move expected to result in up to 165 job losses.

DSV Panalpina forecasts full-year EBIT before special items for 2019 of DKK6,600 million including amortization of customer relationships of approximately DKK100 million, of which DKK80 million are related to Panalpina. Transaction and integration costs (reported as special items) for 2019 are expected to amount to approximately 30% of total expected restructuring costs of DKK2,300 million.

DSV Road, a market leader in Europe but with extensive operations in North America and South Africa, posted revenue of DKK7,698 million in the third quarter, down from DKK7,812 in the same quarter of 2018, with EBIT declining 2.2% from DKK345m to DKK343m over the period.

“Revenue was impacted positively by the acquisition of Panalpina, but negatively by the divestment of the U.S.-based Market Transport (and revenue of approximately DKK600 million) as per April 1,” the company reported.

The acquisition of Panalpina delivered 500,000-square meters and annual revenue of around DKK2 billion to DSV Solutions, the company’s warehouse, logistics and e-commerce arm. The division’s EBIT in the third quarter of 2019 was DKK239 million, up from DKK184 million a year earlier.

“The general economic slowdown continued and especially the weak development in the automotive industry impacted market growth in the third quarter of 2019,” reported the company.

More articles by Mike