A sharp reduction in costs helped CMA CGM boost profits in the third quarter, but the purchase of CEVA Logistics continues to weigh heavily on the bottom line of the container shipping and logistics conglomerate.

CMA CGM’s core earnings before interest, taxes, depreciation and amortization (EBITDA) of $1.012 billion in the third quarter of this year were almost three times higher than the $364.5 million reported in the third quarter of 2018, while the carrier also reported an EBITDA margin of 13.3%, up from just 6% a year earlier.

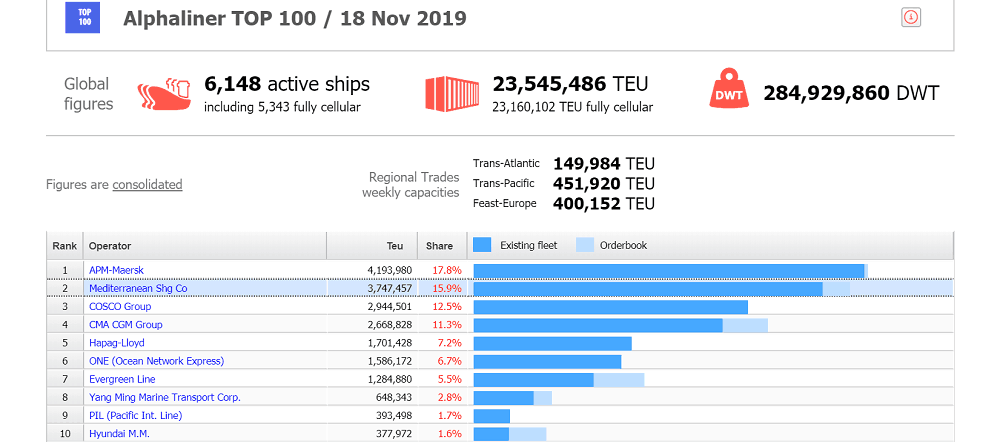

CMA CGM, ranked fourth globally in terms of container shipping capacity by Alphaliner (see table below), also saw revenue surge 25.8% year-on-year in the third quarter to $7.624 billion.

However, while the carrier’s profit from shipping operations rose to $158.9 million in the period from $103.1 million a year earlier, its overall consolidated net profit slumped to $45.4 million from $103.1 million in the third quarter of 2018.

The CEVA factor

CMA CGM denied the completion of its multi-billion purchase earlier this year of CEVA Logistics, ranked 13th among global third-party logistics providers (3PLs) by revenue in 2018 according to Armstrong & Associates (see table below), was overburdening the company with debt. However, it did confirm it would continue to divest in a bid to raise $2 billion by next year.

“In line with the CEVA Logistics acquisition financing plan, the Group has lightened its capital structure by divesting and refinancing certain of its assets,” the company reported.

“These transactions should enable the Group to raise more than $2 billion in cash by mid-2020, extend the Group’s debt maturities and reduce its net debt by more than $900 million.”

The plan includes raising $860 million from vessel sale and leaseback transactions, of which $650 million was completed during the third quarter of 2019. An additional $210 million is scheduled “to close over the coming weeks,” said CMA CGM.

“The proceeds will primarily be used to pay down the loan contracted to acquire CEVA Logistics, with the balance currently standing at $200 million,” it reported.

CEVA not terminal, says CMA CGM

The carrier will also raise $968 million by selling stakes held in 10 port terminals to Terminal Link, a joint venture set up in 2013 and owned 51% by CMA CGM and 49% by China Merchants Port (CMP). Terminal Link currently holds stakes in 13 port terminals.

“Terminal Link will finance these acquisitions through a capital increase of $468 million subscribed by CMP and a loan by CMP that in eight years will be converted into a capital increase subscribed by CMA CGM,” reported the carrier.

“The transaction, which is subject to antitrust and other regulatory approvals, is expected to close in Spring 2020.”

Logistics profits forecast pushed back

CMA CGM has now pushed back on its profitability hopes for its newly acquired logistics business which it values at $1.7 billion.

“The Group confirms the profitability targets previously announced for CEVA Logistics but sets their effects to 2023/2024 due to the challenging environment in certain industrial sectors,” it reported.

“The Group remains firmly committed to returning CEVA Logistics to a sustainable and structural profitability, thanks to the wide variety of measures and investments undertaken since the acquisition closed.”

CEVA’s new Marseille-based operations centre is now, according to CMA CGM, enabling the Group to leverage the “disciplined management of its logistics operations and generate revenue synergies with the signing of several new contracts”.

It added, “However, CEVA Logistics’ exposure to the automotive and technologies industries is continuing to dampen demand in both the Freight and the Contract Logistics services segments.

“In addition, the significant investments made to transform CEVA Logistics are also weighing on margins in the short term.”

Volumes over profits?

In terms of its core container shipping business, CMA CGM appears to be placing more emphasis on volume growth than some of its rivals. In their respective third quarter reports, rival European carriers Maersk and Hapag-Lloyd both emphasized profitability over market share. Maersk’s third quarter results revealed that volumes increased just 2.1% year-on-year, while Hapag Lloyd reported a slight contraction in volumes.

CMA CGM, by contrast, saw volumes increase 5.1% in the third quarter, aided by the acquisition of European short-sea operator Containerships.

“This growth comes primarily from the growth of the Group short sea business and a push to rebalance our trades to help reduce our operating expenditures,” said CMA CGM.

Despite the increase in volumes, the carrier cut its operating costs during the third quarter. “Ongoing deployment of the performance improvement plan delivered a further reduction in unit operating costs of $25 per twenty-foot equivalent unit (TEU), compared with the second quarter of 2019 and of $89 per TEU, compared to the third quarter of 2018,” it reported.

CMA CGM Group said that it would continue to pursue “actions to reinforce its operational efficiency and cost discipline in its shipping business.”

It added, “During the third quarter of 2019, the Group further enhanced its operating performance, led by its shipping activity.

“In particular, this reflected the optimized use of its state-of-the-art fleet and the ability to adapt its organization to market developments.”

More articles by Mike