DSV Panalpina (CPH: DSV) estimated the coronavirus pandemic negatively impacted first-quarter earnings before interest and taxes (EBIT) by about 250 million Danish kroner ($36.6 million) and said it was taking steps to reduce annual costs by DKK 1.4 billion ($205 million).

“When this year started, we were really looking forward to demonstrating the strength of the DSV Panalpina combination,” said Group CEO Jens Bjørn Andersen in the interim financial report for Q1 released Thursday. “The COVID-19 crisis has obviously changed the agenda for everybody and hit our markets in a severe way, but we have been able to continue the integration as planned.

“All things considered, we have delivered satisfactory results in Q1 2020 and our asset-light business model has shown its strength,” Andersen said.

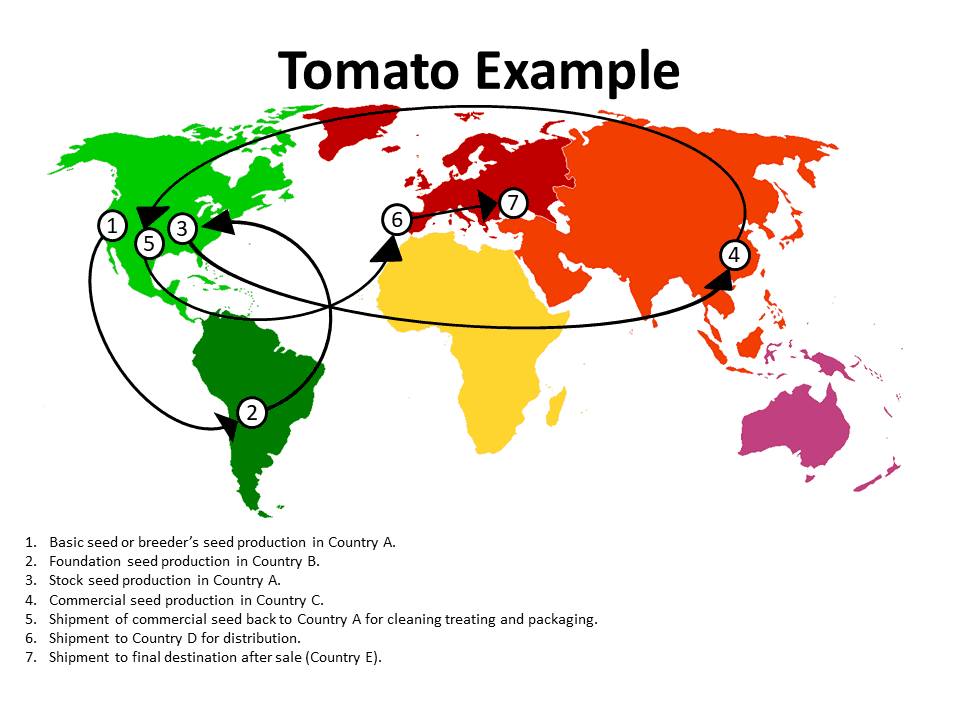

DSV completed its $5 billion acquisition of Panalpina in August. The combination of the two companies created one of the world’s largest transportation and logistics behemoths.

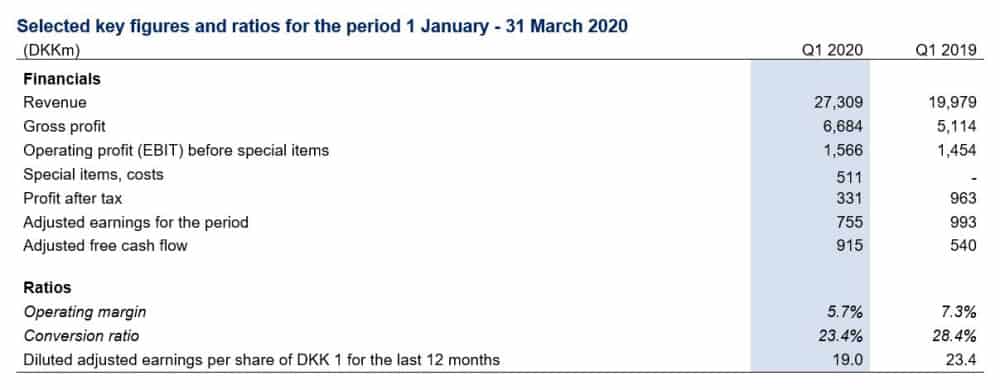

Combined, DSV Panalpina Q1 2020 revenue was DKK 27.3 billion ($4 billion), up from DKK 19.9 billion ($2.9 billion) in the same period last year, an increase of 36.6%, primarily because of the acquisition. Gross profit increased from DKK 5.1 billion ($747 million) to DKK 6.6 billion ($967 million), a 30.6% increase. EBIT was DKK 1.56 billion ($228 million), up from DKK 1.45 billion ($212 million) year-over-year, a 7.6% increase.

The company said the Panalpina acquisition drove strong growth in the Air & Sea business. Q1 EBIT in that unit was up 12.9% year-over-year, from DKK 998 million ($146 million) to DKK 1.1 billion ($161 million).

COVID-19 significantly impacted the Road unit in March, management said. EBIT was down 12.8% year-over-year, from DKK 298 million ($43.6 million) in 2019 to DKK 259 million ($37.9 million) this year.

Management also attributed 12.6% revenue growth in the Solutions business to the Panalpina acquisition.

“Similar to the Road division, the COVID-19 impact came in March, with a sharp decline in order lines. Automotive and fashion were the worst-hit industries,” the company said.

A Solutions EBIT decrease of 17.2% — from DKK 193 million ($28.2 million) to DKK 159 million ($23.3 million) — was caused by one-off costs related to specific customer contracts and distribution center startup costs, DSV Panalpina said.

Andersen said effects from the coronavirus pandemic are being felt in the second quarter as well.

“The crisis will have a significant impact on activity levels in the coming months and we are taking the necessary steps to adapt while supporting the supply chains of our customers and ensuring the safety and health of our employees,” he said.

Reportedly 3,000 employees worldwide are being let go as part of the cost-saving initiatives. Denmark-headquartered DSV Panalpina has about 60,000 employees in more than 80 countries.

Some cost savings previously were achieved with the relocation of Panalpina’s headquarters in Switzerland to Denmark, and DSV has a good track record of successfully integrating major acquisitions. It has acquired DFDS Dan Transport Group, Frans Maas, ABX and UTi Worldwide since 2000.

According to the web presentation Thursday, Panalpina operations have been integrated with DSV’s in more than 30 countries, representing about 70% of Panalpina volume. The company said in October it was suspending acquisitions for 12 to 18 months to focus on the integration of Panalpina.

In mid-March, DSV Panalpina withdrew its financial outlook for 2020 and suspended its share buyback program.

“As a result of the global outbreak of COVID-19, supply chains and the global transport and logistics markets are currently seeing a substantial negative impact and we are unable to accurately assess the magnitude of this impact,” the company said in Thursday’s Q1 results release.