Global freight forwarder Kuehne + Nagel Group (OTCMKTS: KHNGY) used its “agile structure, rigorous cost management and high-quality service offerings” to counter potentially devastating financial impacts from the coronavirus pandemic during the first half of the year, said CEO Detlef Trefzger in a statement on Tuesday.

The Swiss company recorded a first-half, pretax profit of CHF 419 million ($449 million), down 18% from the same period last year.

“We took the right measures early on and successfully managed Kuehne + Nagel under these difficult conditions,” Trefzger said.

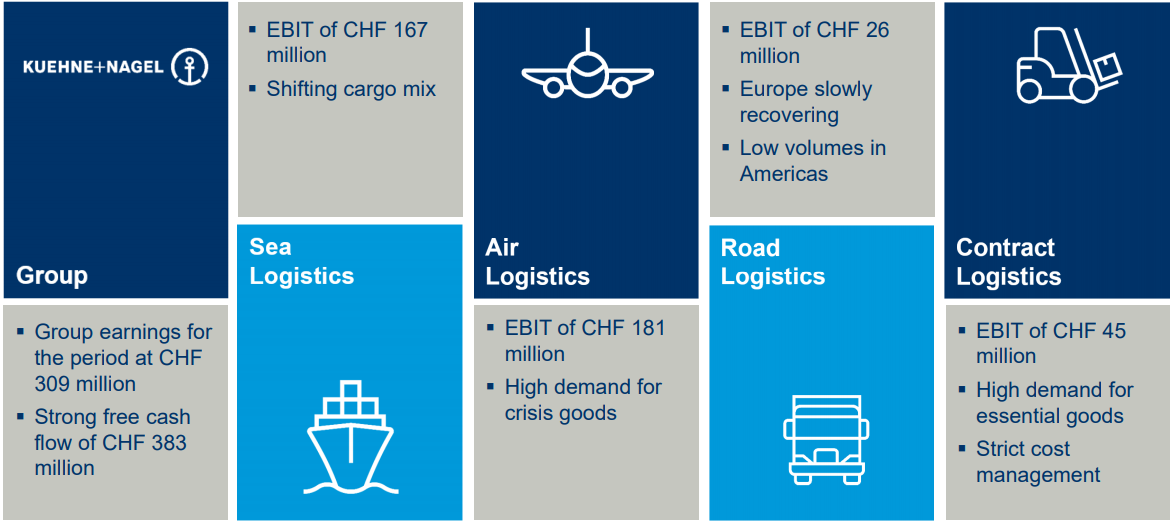

Kuehne + Nagel breaks down its logistics business across four segments: ocean, air, road and contract.

Turbulent seas

In its ocean transport segment, the company handled 1.1 million twenty-foot equivalent units (TEUs) of containerized freight during the second quarter of 2020, an 11.7% drop compared to the same period last year. This resulted in a second, pretax profit of CHF 88 million ($94 million)for the segment, down 29% compared to the same period in 2019.

Kuehne + Nagel said its first-half, pretax profit for the ocean transport segment was CHF 167 million ($179 million), down about 29% compared to the same period last year.

The company said it gained some traction in container traffic through pharmaceutical, refrigerated and e-commerce cargoes, but this volume was not enough to offset the “significant decline in the high-yielding SME customer portfolio.”

The forwarder’s second-quarter pretax profit from airfreight registered at CHF 110 million ($118 million), up 17% compared to the same period last year. It handled about 315,000 tons of airfreight during the second quarter, down 22% from the same period in 2019.

Air traffic control

Kuehne + Nagel attributed its second-quarter airfreight profit to the high demand for goods to fight the coronavirus pandemic, which required the purchase of all-cargo charters and space on certain passenger-to-cargo flights.

“With the gradual resumption of passenger services since June, a slight normalization of the general market conditions is visible,” the company said.

The company’s second-quarter success in airfreight generated a 4% increase in pretax profit for CHF 181 million ($194 million), compared to CHF 174 million ($186 million) for the first half of 2019.

Over the road

Between April and May, Kuehne + Nagel said it experienced a “significant decline” in its over-the-road business in Europe and North America during the second quarter, but since June has seen demand from European shippers increase to pre-COVID-19 levels.

“In North America, demand for all product segments — with the exception of pharma and e-commerce — was significantly lower than in the previous year,” the company said.

Road logistics services for the second quarter generated CHF 9 million ($9.6 million) in pretax profit, down 57% from the same period last year, with a first-half pretax profit of CHF 26 million ($28 million), down 42% compared to the first half of 2019.

Contract logistics

Kuehne + Nagel sustained a second-quarter pretax profit within its contract logistics segment of CHF 28 million ($30 million), down only 9.7% against the same period last year.

The company said a more significant reduction in demand for contract logistics services was “mitigated by stringent cost management.”

Contract logistics accounted for CHF 26 million ($28 million) for the first half of the year, down 42% compared to the same period in 2019.

COVID uncertainty

Kuehne + Nagel, which has more than 80,600 employees worldwide, said its goal is to ensure continuity of its business operations for the remainder of the year, including monitoring the business results of its recent acquisitions.

“We expect the second half of the year to continue to be marked by major uncertainties,” Trefzger said.

Related articles

CEO says Kuehne + Nagel well positioned for major challenges ahead

XPO to acquire Kuehne + Nagel’s UK contract logistics unit

Kuehne + Nagel acquires overland logistics operations of Dutch-based Rotra

Click for more FreightWaves/American Shipper articles by Chris Gillis.