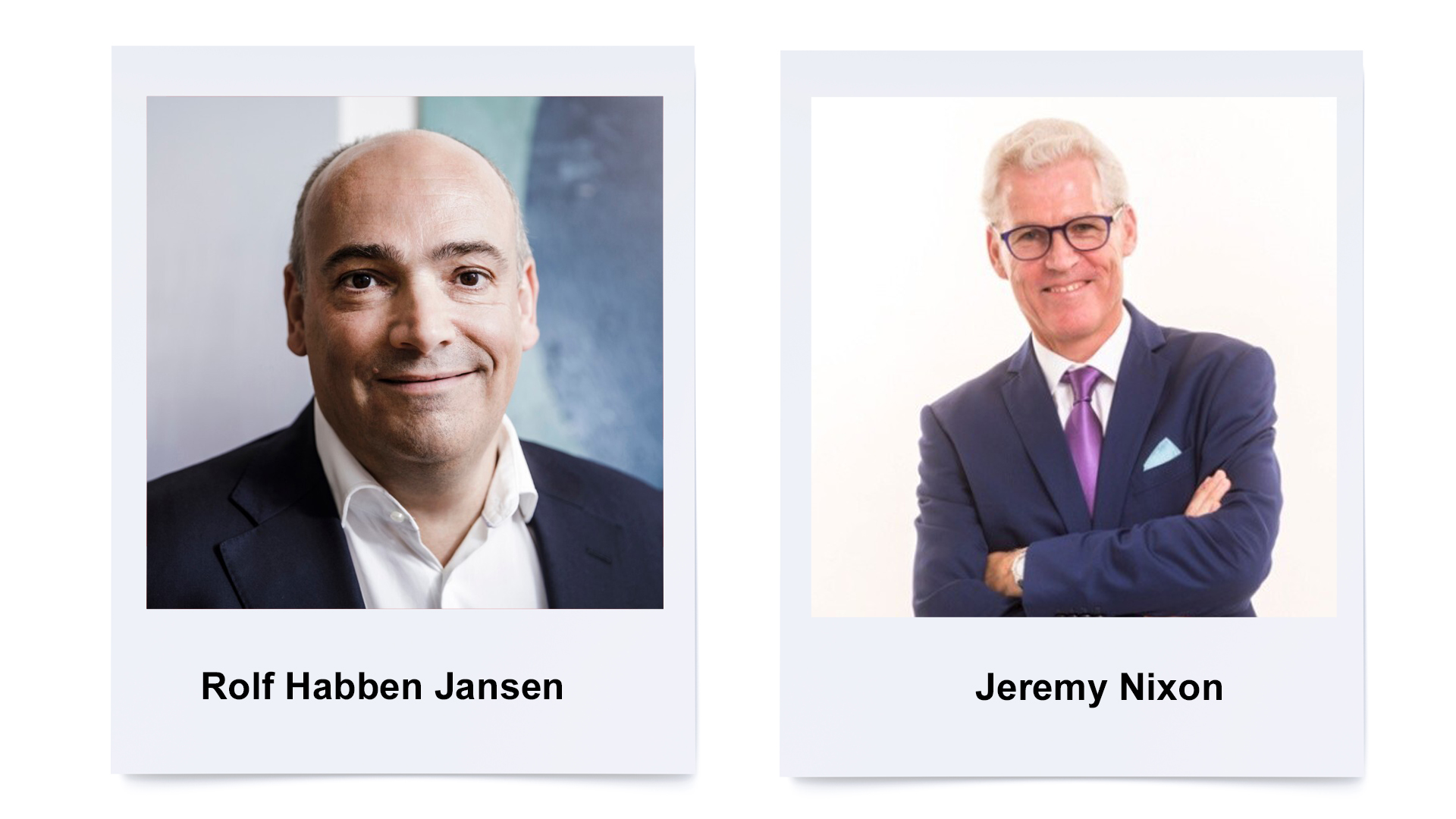

Rolf Habben Jansen, CEO of Hapag-Lloyd, and Jeremy Nixon, CEO of ONE, have been elected co-chairs of the board of directors of the World Shipping Council (WSC).

The board of directors also announced this week it had welcomed Matson Navigation and X-Press Feeders as new WSC members.

Jansen and Nixon have begun serving a two-year term as co-chairs. They succeeded Ron Widdows, who had served as the WSC chairman for more than a decade and previously announced his intention to step down once a successor was elected.

“WSC today is the unified voice of liner shipping and covers a wide range of industry topics, engaging with governments and organizations all over the world. We expect that to only expand as we head into the future and WSC continues its work to shape the future growth of a socially responsible, environmentally sustainable, safe and secure shipping industry,” Nixon said.

John Butler, president and CEO of the Washington-headquartered WSC, welcomed Matson Navigation and X-Press Feeders to the organization.

“Expanding our membership broadens our perspective when representing the liner sector and we look forward to participation from Matson and X-Press Feeders’ representatives,” Butler said.

Both companies elected to appoint representatives to WSC’s board of directors. Matt Cox, Matson’s chairman and CEO, and Tim Hartnoll, executive chairman of X-Press Feeders, have joined the WSC board.

Hyliion

Hyliion has hired Jose Oxholm as vice president, general counsel and chief compliance officer.

Texas-headquartered Hyliion, which offers electrified powertrain solutions for Class 8 commercial vehicles, said Oxholm will be responsible for the company’s legal and compliance functions.

Oxholm has more than 20 years of automotive and transportation experience and has held top management positions at LoJack, Ford Motor, Goodyear and Meritor, Hyliion said.

“Jose is a seasoned leader whose deep industry experience will be a valuable asset as we continue to grow and make progress toward our commercialization strategy,” said Thomas Healy, founder and CEO of Hyliion.

Davies Turner

Davies Turner has promoted Tony Cole to head of ocean.

Cole is tasked with leading Davies Turner’s ocean freight-forwarding services.

He replaced Kieron Larkin, who is leading a strategic review of the company’s computer systems and software that will underpin all its freight-forwarding services.

Cole joined U.K.-based Davies Turner in 1990 as ocean import manager. While head of supply chain services, he was instrumental in the launch and development of Davies Turner’s direct weekly Express China Rail service in 2018.

French-American Thanksgiving: CMA CGM donates 10,000 turkeys

Hapag-Lloyd CEO cautious despite high demand, rates

ONE makes giant leap in quarterly profit

Click for more American Shipper/FreightWaves stories by Senior Editor Kim Link-Wills.