This is no ordinary year for American shippers and freight forwarders that are attempting to finalize their annual ocean service contracts with the container carriers.

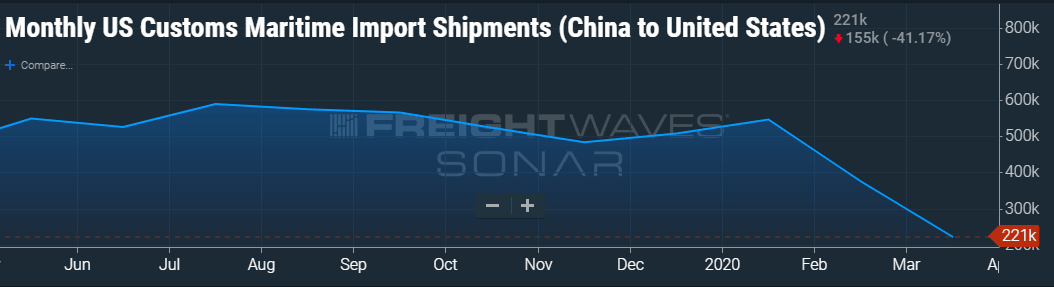

The uncertainty of how much cargo will be available from the shippers and the amount of capacity offered by the carriers for the next contract season, which generally starts in May, remains anyone’s guess in the face of the ongoing coronavirus pandemic.

“The biggest obstacle we face in service contract negotiations this year is the great unknown about how much volume will move,” said Rich Roche, vice president of international transportation at Mohawk Global Logistics in Syracuse, New York, who also serves as the NVOCC (non-vessel-operating common carriers) subcommittee chair for Washington, D.C.-based National Customs Brokers and Forwarders Association of America (NCBFAA). “Few cargo owners can give confident forecasts right now.”

“How long this global reduction in demand, and thus carrier reductions in service will last, is unknown,” Peter Friedmann, executive director of the Agriculture Transportation Coalition, which is also based in Washington, D.C., and represents numerous agricultural and forest product exporters, told American Shipper in an interview.

“Thus, it is very difficult for carriers to make service/sailing commitments, and without those commitments, shippers and NVOCCs are cautious about making volume commitments with a particular carrier,” he said.

Remote negotiations

Interactions that typically occur during ocean service contract negotiations – face-to-face meetings and office conference calls – were disrupted this spring as negotiators among shippers, forwarders and ocean carriers scrambled to set up home offices in March and early April due to the emergency COVID-19 social distancing restrictions.

“We experienced some limited delays in response to timing as the carrier corporate account and trade/pricing management teams shifted to ‘work remote’ setups,” said a logistics executive for a U.S. equipment manufacturer, who requested anonymity because they did not have corporate permission to speak publicly about its service contract negotiations.

Carmen Gerace, chief transportation officer for Philadelphia-based forwarder-NVOCC BDP Transport, said the back-and-forth between the ocean carrier representatives and his team via email to finalize service contracts was more laborious this year. He also lamented “the lack of face-to-face communication to discuss and negotiate with an individual” during the pandemic.

“Contract negotiations are a little tougher without all the face-to-face meetings, but in some ways the meeting platforms make us a bit more efficient by eliminating travel,” Mohawk Logistics’ Roche said.

Forwarder-affiliated NVOCCs often enter service contracts for container space with ocean carriers and retail it back to shippers on a spot market basis. Neutral ocean freight consolidators, which enter service contracts for capacity with ocean carriers, sell their services to other forwarders on a spot-rate basis.

Negotiating points

Due to the unknowns caused by COVID-19, some shippers and forwarders have considered extending their current carrier contracts by 30 days, 60 days, or through the end of the year, to even rolling them over altogether. “That works for incumbents already in a contract, but new bids have to be treated separately,” Roche said.

This year’s service contract negotiations might allow shippers to zero-in on certain ongoing service and fee concerns with the ocean carriers, such as container availability and demurrage and detention fee assessments, said Friedmann of the Agriculture Transportation Coalition.

The U.S. Federal Maritime Commission (FMC) on April 28 announced that it has finalized its long-awaited guidance on how it will assess whether ocean carriers’ and marine terminal operators’ demurrage and detention practices are reasonable.

“With the entire U.S. international export and import economy demanding that the FMC issue its rule establishing demurrage and detention guidelines, will ocean carriers be willing to accept the detention/demurrage contract terms sought by shippers?” Friedmann said.

“As these charges, as well as ‘earliest return date’ (ERD) charges, have over the past few years often matched the actual freight charges, this is a major cost to shippers and revenue for carriers,” he said. “With COVID-19 constraining volumes for both shippers and carriers, and thus hurting the bottom line, detention and demurrage, and ERD, will be difficult, but critical negotiations.”

To assist its members, the Agriculture Transportation Coalition drafted language which could be inserted into service contracts to protect exporters and importers from unfair demurrage and detention charges by the carriers.

“Some of our members report that they have proposed some of those provisions (without sharing which provisions they are selecting) and have had some success in gaining their inclusion,” Friedmann said.

The logistics executive for the U.S. equipment manufacturer noted the surprising drop in bunker surcharges while the global ocean carrier industry implements the International Maritime Organization January 1, 2020 mandate to power ships with new 0.5% sulfur bunker fuel.

Shipping industry analysts last year estimated that the implementation of the IMO 2020 low-sulfur fuel mandate could cost the container shipping industry another $10 billion to $20 billion on top of its usual annual fuel bill, which the shippers have been expected to absorb through increased bunker surcharges from the ocean carriers.

The unexpected change in container volumes due to the COVID-19 disruption during the first quarter of 2020 “is driving a significant amount of internal dialogue as we review annual fuel cost impact forecasts that may change significantly from original estimates established in 2019,” the logistics executive said.

Roche said, so far, the ocean carriers have managed their capacity well enough to prevent ocean container rates from significantly falling. “But with so many void sailings to navigate through, service consistency has suffered quite a bit,” he added. “It’s hard to put the contract to work when there’s no ship to load that week.”

Service contract filing relief

Shippers and forwarders, with whom American Shipper spoke in recent days, also praised the FMC’s April 27 order temporarily allowing service contracts to be filed up to 30 days after they take effect to provide relief to shippers and container carriers impacted by the coronavirus pandemic. The order will remain in effect through December 31, 2020.

Under the Shipping Act, service contracts reached between ocean carriers and shippers must be filed within 30 days to the FMC for monitoring competition of U.S. container shipping.

The relief measure was identified by the Fact Finding 29 Supply Chain Innovation Teams, which include more than 50 industry representatives who hold regular telephone meetings with FMC Commissioner Rebecca Dye to identify pain points in container shipping due to the COVID-19 pandemic.

“We applaud the FMC’s initiative at this time in the interest of keeping freight moving,” Roche said. “The benefit will be felt more in relieving some of the administrative burden of [service contract] filing.”

The U.S. equipment manufacturer’s logistics executive interviewed by American Shipper also called the FMC order “a positive development” toward reducing service contract filing burdens during the COVID-19 pandemic. “This is especially relevant within a contract period when critical lanes must be agreed to and added with relatively short notice,” the executive said.